Completing the Free Application for Federal Student Aid (FAFSA) is a crucial step for students and families preparing for the financial journey of higher education.

While many assume the FAFSA is only for those in need of federal loans, it opens the door to a wide range of financial support options, from grants and scholarships to work-study programs.

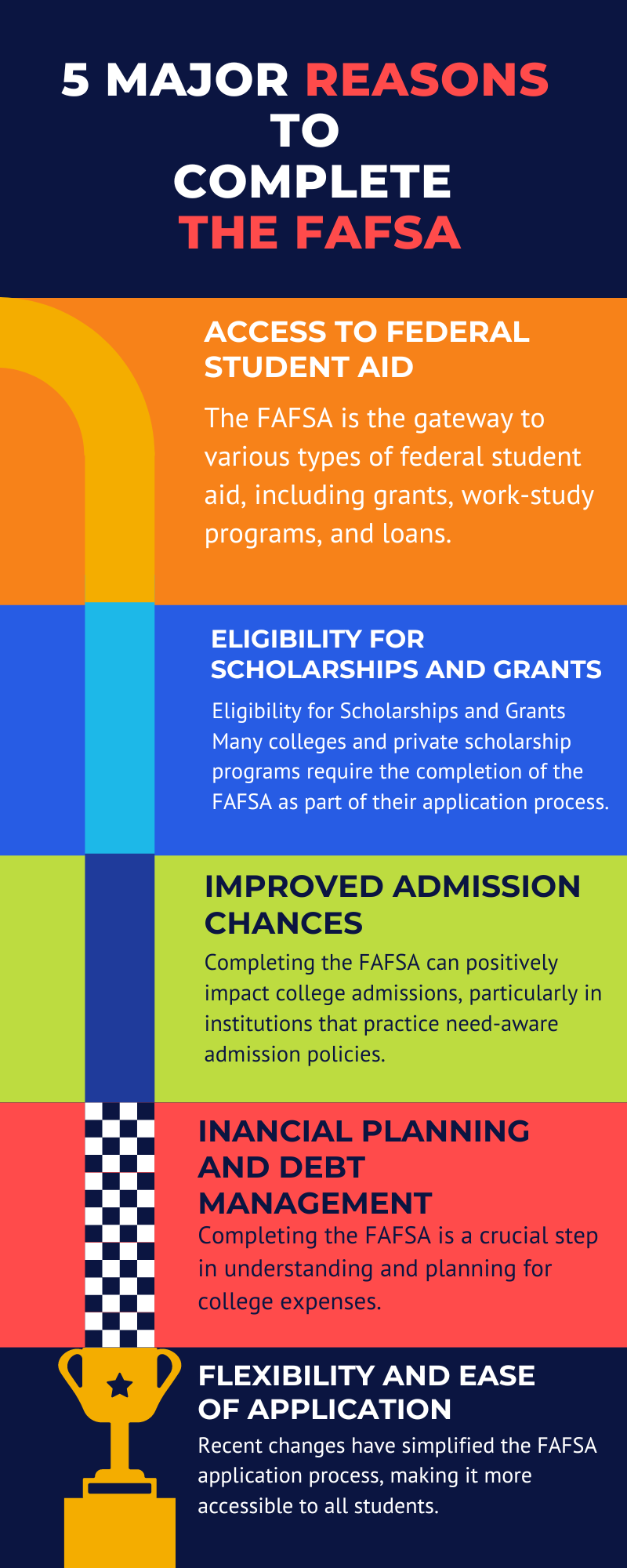

Here are major reasons why completing the FAFSA can significantly ease the cost of college and set you on the path to financial success.

Reason #1: Access to Federal Student Aid

Completing the Free Application for Federal Student Aid (FAFSA) is the first step toward unlocking an array of federal financial aid options tailored to help students manage the cost of college.

By filling out the FAFSA, students and their families open the door to several forms of assistance, each designed to support different financial needs and reduce the burden of college expenses.

Types of Federal Student Aid Available Through the FAFSA

- Grants: Federal grants, like the Pell Grant, are awarded based on financial need and do not require repayment.

- Work-Study Programs: The Federal Work-Study program offers students part-time employment opportunities, typically on campus, allowing them to earn money to cover educational and personal expenses.

- Federal Loans: Federal student loans, available through the FAFSA, generally come with lower interest rates and more flexible repayment options compared to private loans.

No Income Restrictions

One of the key benefits of the FAFSA is its accessibility to all students, regardless of family income. There are no income restrictions, so students from a wide range of financial backgrounds can apply and determine what aid options may be available to them.

- Inclusive Financial Support: Since aid eligibility can depend on various factors beyond income, such as family size and the number of dependents in college.

- Eligibility Beyond Income: Even students from higher-income families may qualify for certain types of aid, including unsubsidized loans and work-study.

Reason #2: Eligibility for Scholarships and Grants

Completing the FAFSA not only qualifies students for federal aid but also broadens access to various scholarships and grants provided by colleges, universities, and private organizations.

Many of these scholarships and grant programs require completion as a prerequisite, making it a critical step for students looking to secure as much financial support as possible.

Why FAFSA is Key for Scholarship and Grant Eligibility

Most colleges and private scholarship programs use FAFSA data to assess a student’s financial need and eligibility for their aid offerings.

By submitting, students provide these institutions with important financial details that help them determine whether they qualify for additional support.

- Institutional Scholarships and Grants: Many schools allocate their scholarships based on information obtained from the FAFSA.

- Private Scholarship Programs: Numerous external organizations require FAFSA completion to be considered for financial support.

The Importance of Early FAFSA Submission

Submitting the FAFSA early is essential for maximizing the potential for aid. Many financial aid resources are limited, and funds can be depleted as applications roll in.

Completing the FAFSA as soon as it becomes available can give students an advantage in the financial aid distribution process.

- First-Come, First-Served Basis: Many scholarships and grants are distributed in order of application, meaning students who submit early have a higher chance of receiving aid before resources are exhausted.

- Competitive Advantage: By submitting promptly, students position themselves more favorably in the financial aid review process, increasing their likelihood of receiving limited funds.

The Benefits of Additional Funding Sources

Beyond federal aid, securing scholarships and grants from colleges and private sources can substantially reduce the need for student loans, lessening financial burdens during and after college.

Grants and scholarships don’t require repayment, so maximizing these sources of funding is one of the most effective strategies for lowering out-of-pocket college expenses.

- Reduced Debt Burden: More scholarships and grants mean fewer loans, helping students graduate with minimal debt.

- Greater Financial Flexibility: Accessing multiple aid sources allows students to cover more expenses, easing financial stress throughout their college years.

Reason #3: Improved Admission Chances

Filling out the AFSA can significantly boost a student’s chances of admission to certain colleges, especially those with need-aware admission policies.

The application not only helps with financial planning but also plays a key role in the admissions process at institutions that consider a student’s financial background when making acceptance decisions.

The Role of Need-Aware Admission Policies

Many colleges use a need-aware or need-sensitive approach to admissions, which means they consider a student’s financial need as part of the acceptance criteria.

- Enhanced Admissions Opportunities: For students from lower-income backgrounds, demonstrating financial need can help position them as attractive candidates in need-aware institutions that seek a diverse and balanced student population.

- Alignment with College Goals: Colleges often aim to create economically diverse communities, and understanding a student’s financial profile through FAFSA supports these goals.

Enrollment Management and College Demographics

Enrollment management, a strategy many colleges employ, involves balancing the academic, financial, and demographic composition of each incoming class.

- Building a Diverse Student Body: Colleges use FAFSA data to ensure they meet their diversity and inclusivity goals.

- Strategic Financial Aid Allocation: Colleges can allocate financial aid strategically, often reserving funds for students with demonstrated need.

Reason #4: Financial Planning and Debt Management

Successfully navigating the financial aspects of college is essential for students and families and completing the FAFSA is a critical first step.

With the insights provided, families can establish a realistic plan to finance a college education while minimizing financial strain.

College Expenses with FAFSA

- Grants

- Scholarships

- Loans

The information is essential for making informed decisions about covering tuition, room and board, and other related costs.

- The FAFSA gives students a comprehensive look at aid options, empowering them to evaluate choices based on what best supports their financial well-being.

- Knowing financial aid eligibility helps students budget and plan for college expenses more effectively.

Federal Loans vs. Private Loans

Federal loans offered through the FAFSA often provide more favorable terms than private loans, which can be key in helping students avoid overwhelming debt.

- Lower Interest Rates: They reduce the amount students pay over the life of the loan, making repayment more manageable.

- Flexible Repayment Plans: Federal loans often come with adaptable repayment options that can be adjusted based on income, allowing students to manage their debt without sacrificing financial stability.

Building a Sustainable Financial Future

Thoughtful planning and awareness of financial aid opportunities can help students minimize debt and avoid future financial strain.

Starting college with a clear understanding of potential costs and repayment options fosters better financial habits and empowers students to build a sustainable financial foundation.

- Debt Minimization: Strategizing early and making informed financial choices can prevent excessive debt.

- Long-Term Financial Success: A well-managed approach to college expenses can lead to greater financial stability, helping students to focus on their careers without overwhelming financial pressure.

Reason #5: Flexibility and Ease of Application

Recent improvements to the financial aid application process have made it easier for students to complete the FAFSA form and access the support they need for higher education.

The streamlined process prioritizes user experience, inclusivity, and accessibility, ensuring that applying for aid is within reach for everyone.

Enhanced Accessibility with a User-Friendly Interface

- Simplified Layout: A redesigned interface makes navigating the application much easier, even for students and families who may be new to financial aid processes.

- Streamlined Questions: The application now includes fewer, more straightforward questions, reducing the time and effort required to complete it.

These adjustments ensure that applicants can complete the form more quickly and without unnecessary confusion, allowing students to focus on their educational goals rather than the application process.

Support for All Students

The updated form is designed to be inclusive, considering the needs of various family structures and personal situations.

- Non-Traditional Families: The application now better accommodates students from diverse family backgrounds, ensuring that all household types are represented.

- Special Support for Students with Disabilities: The FAFSA offers added support to assist students with special needs, providing guidance and resources tailored to their specific circumstances.

Financially Accessible to All

One of the most notable aspects of the application process is that it remains entirely free.

- No Application Fees: Students and families are not required to pay any fees, eliminating financial barriers that might prevent some from applying.

- Equal Access for All Applicants: Since there is no cost to apply, students from all financial backgrounds can complete the form and access available financial aid.

Why Every Student Should Apply

Given the ease and accessibility of the application process, students are encouraged to take advantage of this simplified opportunity.

- Quick and Simple Process: Thanks to the recent changes, the application requires less time and effort, making it possible for more students to apply.

- Increased Access to Aid: With a more streamlined process, every student has a better chance of securing the financial aid needed for their education.

Summary

Completing the FAFSA offers numerous benefits, from accessing federal student aid to enhancing admission chances and improving financial planning.

We encourage all students and families to submit the FAFSA to fully take advantage of available financial aid opportunities.

Submitting early is especially important to maximize financial aid benefits and secure access to all potential funding opportunities.